Unbelievable Tips About What Is The Weakness Of Garch Contour Plot Excel

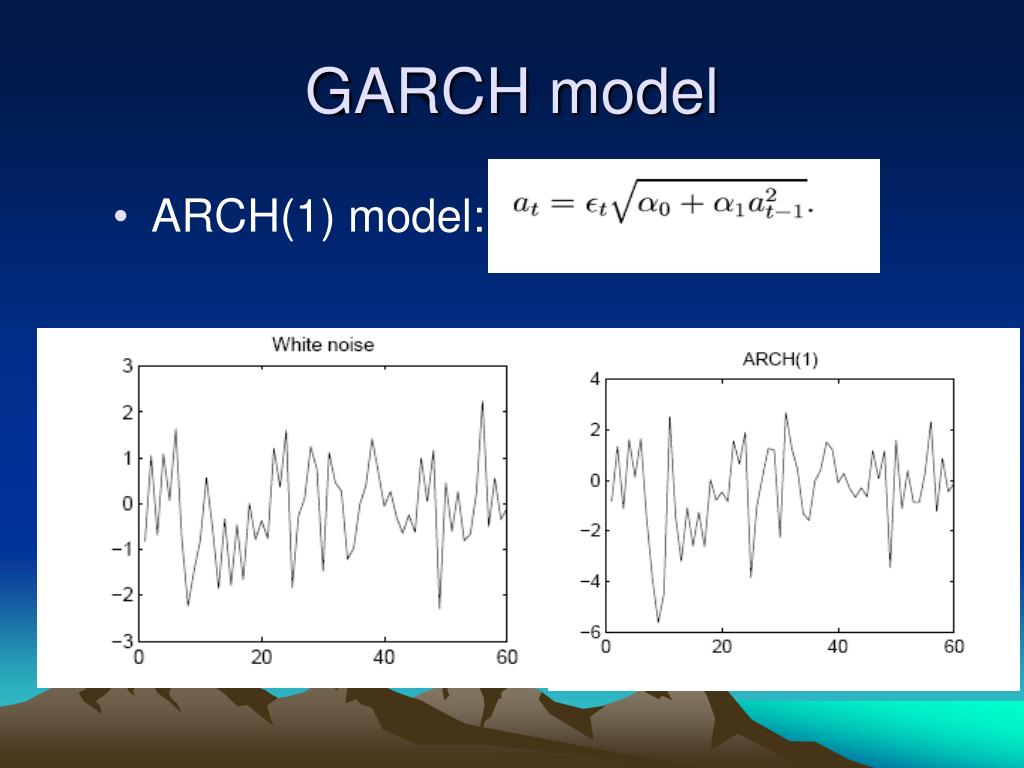

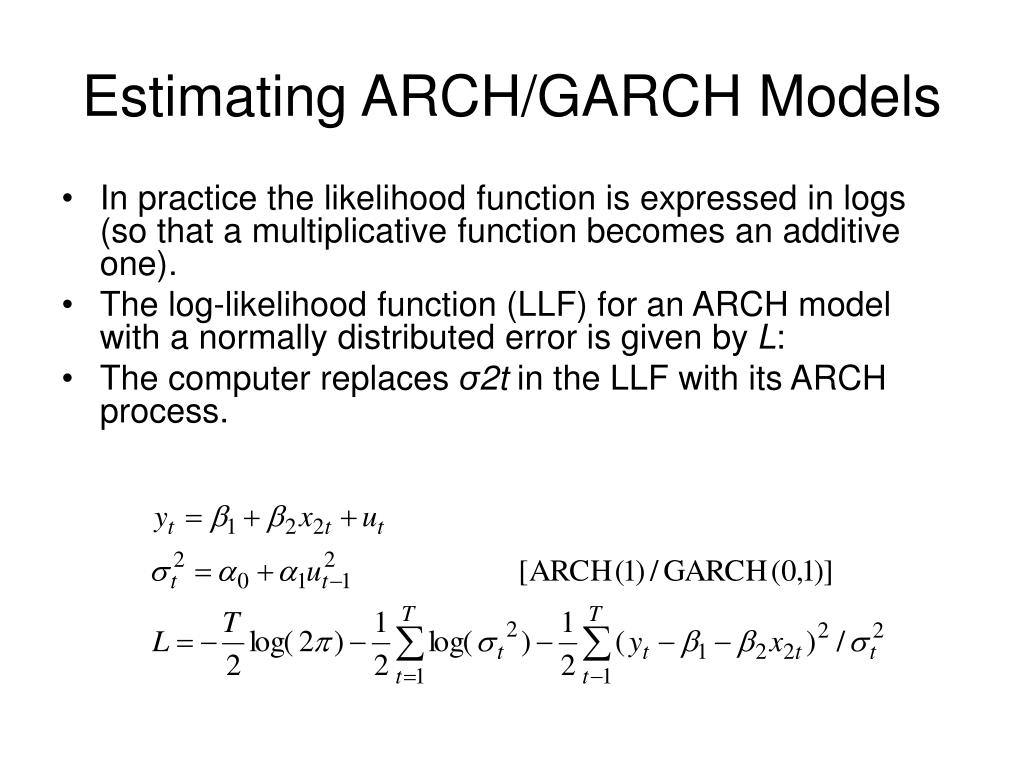

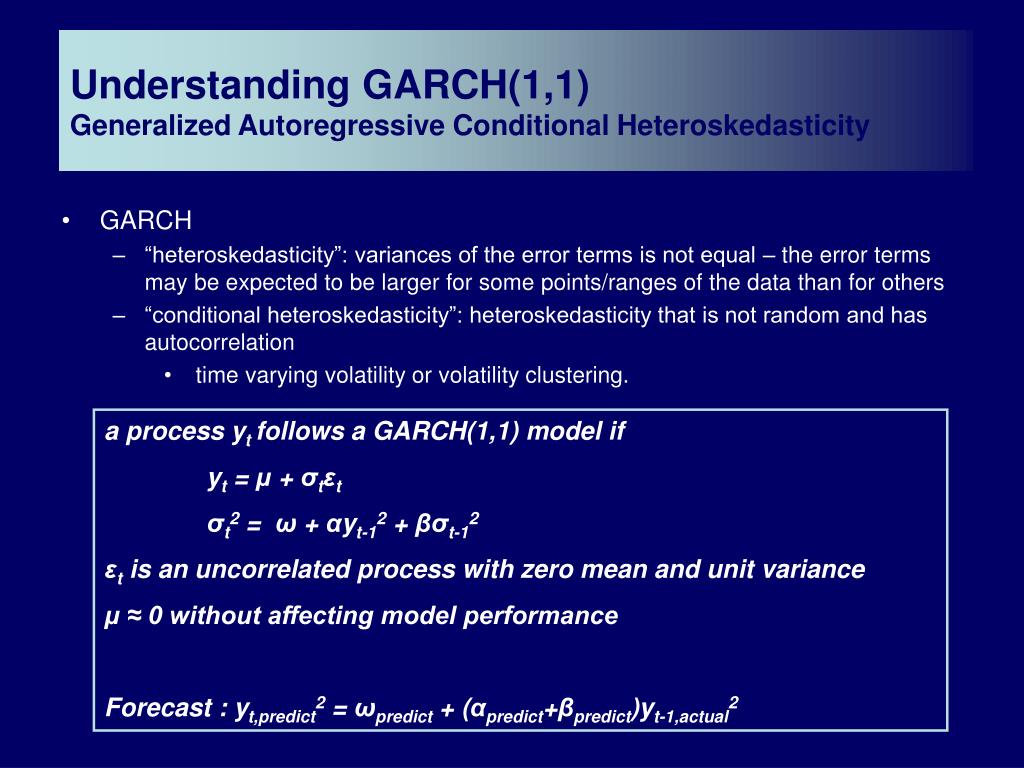

The arch and garch models, which stand for autoregressive conditional heteroskedasticity and generalized autoregressive conditional heteroskedasticity, are.

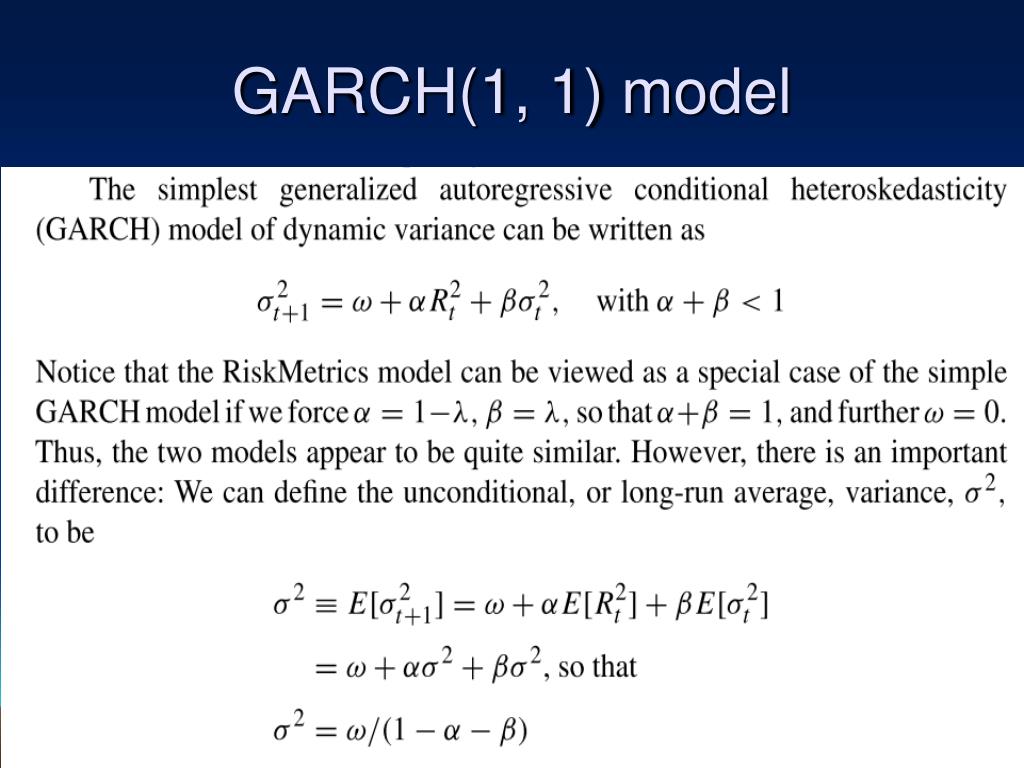

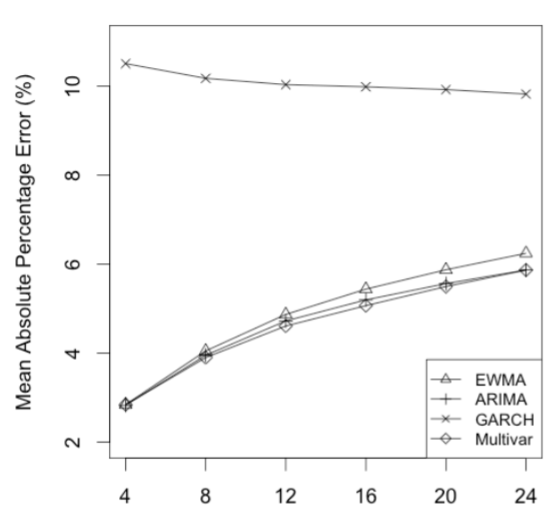

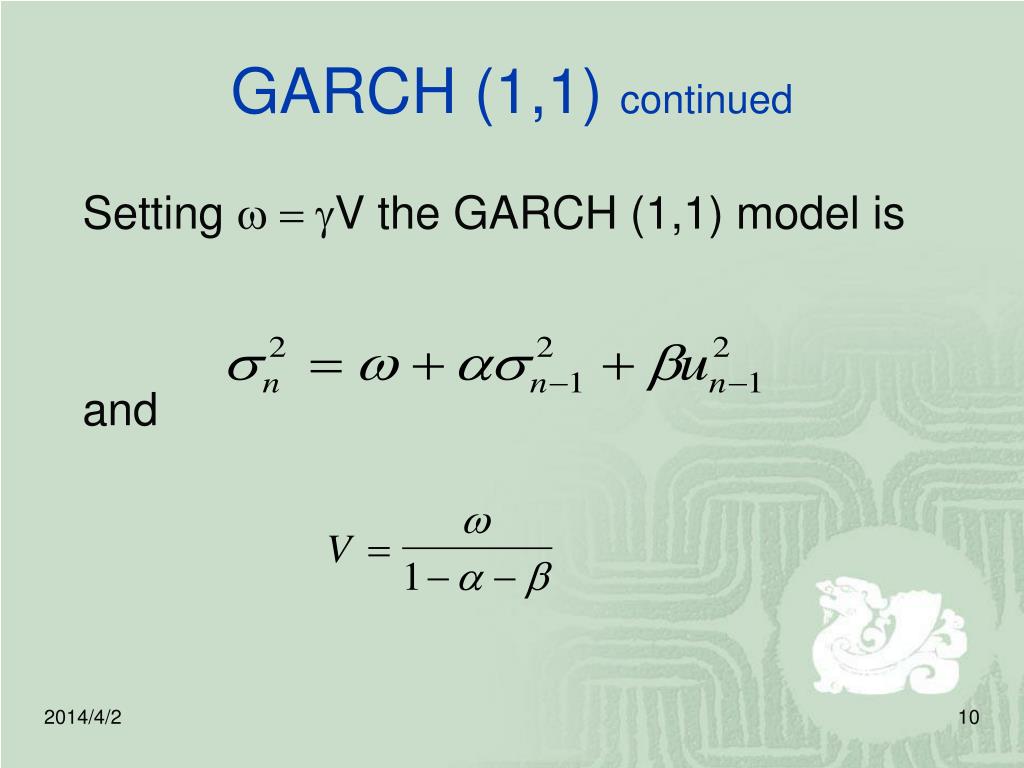

What is the weakness of garch. In this paper we compare three types of forecasts of the volatility of equity returns series. Recent developments in financial econometrics suggest the use of nonlinear time series structures to model the attitude of investors. In some books i read, that the persistence of a garch(1,1) is $\gamma_1+\delta_1$, but e.g.

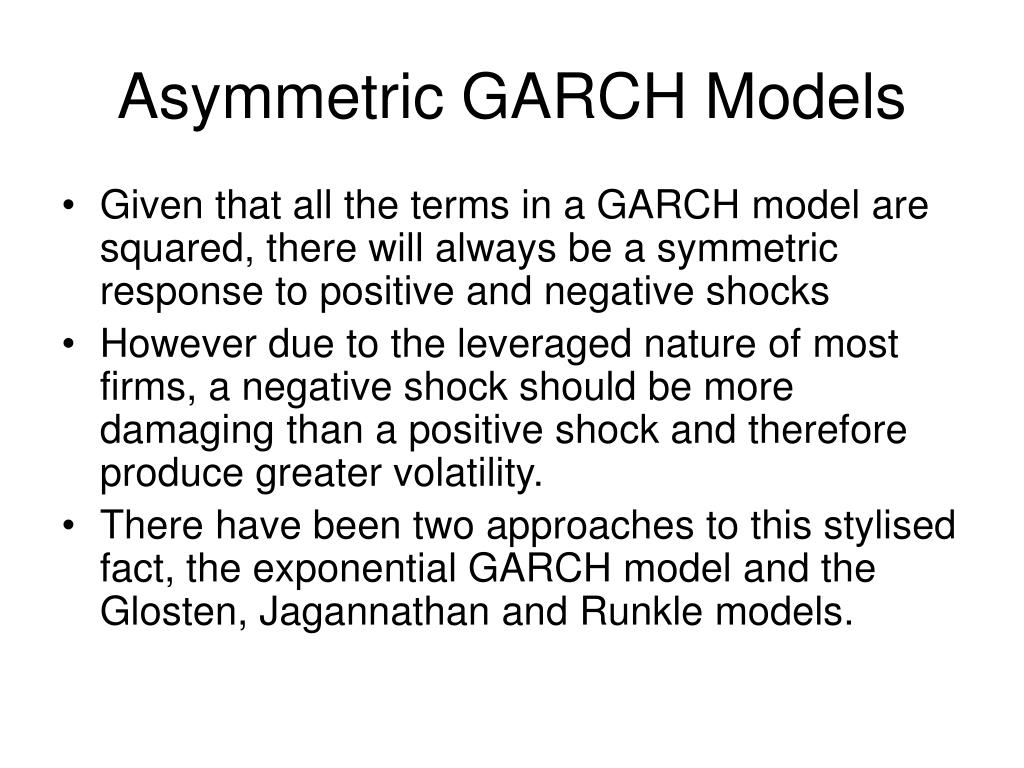

The problem of arch models. In the book by carol alexander on page 283 he talks about only the $\beta$. Symmetric btw positive & negative prior returns.

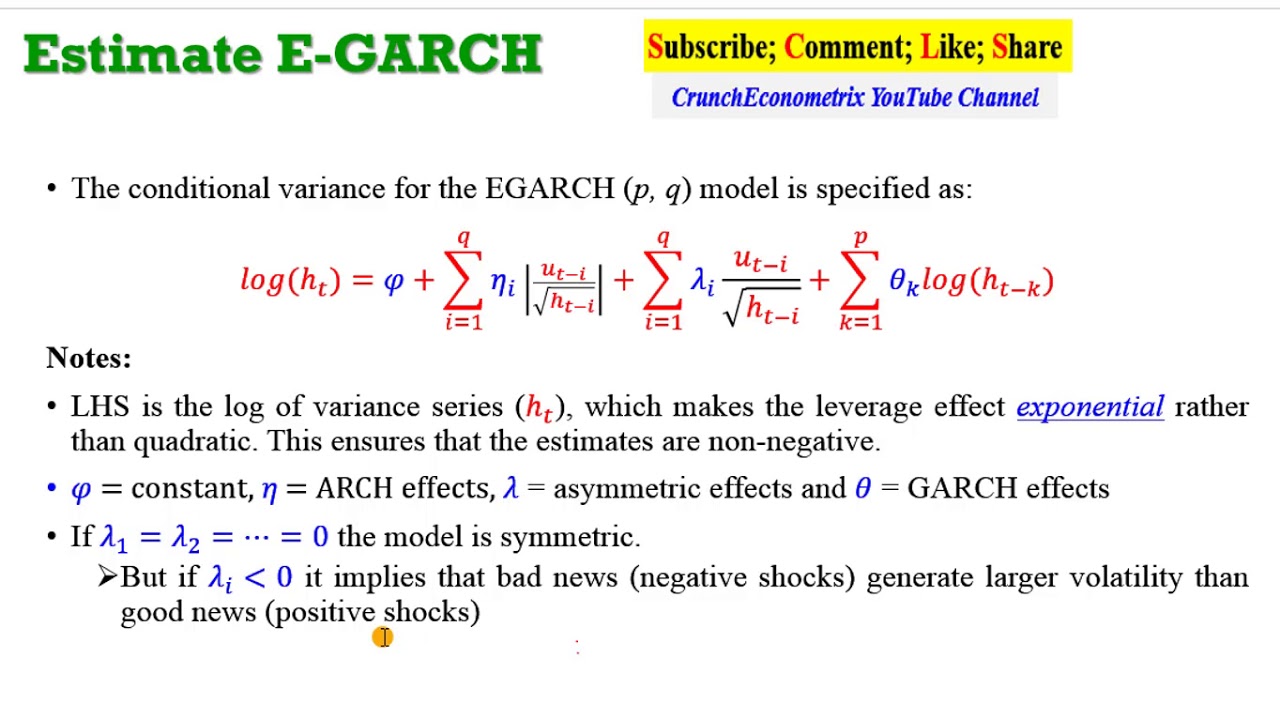

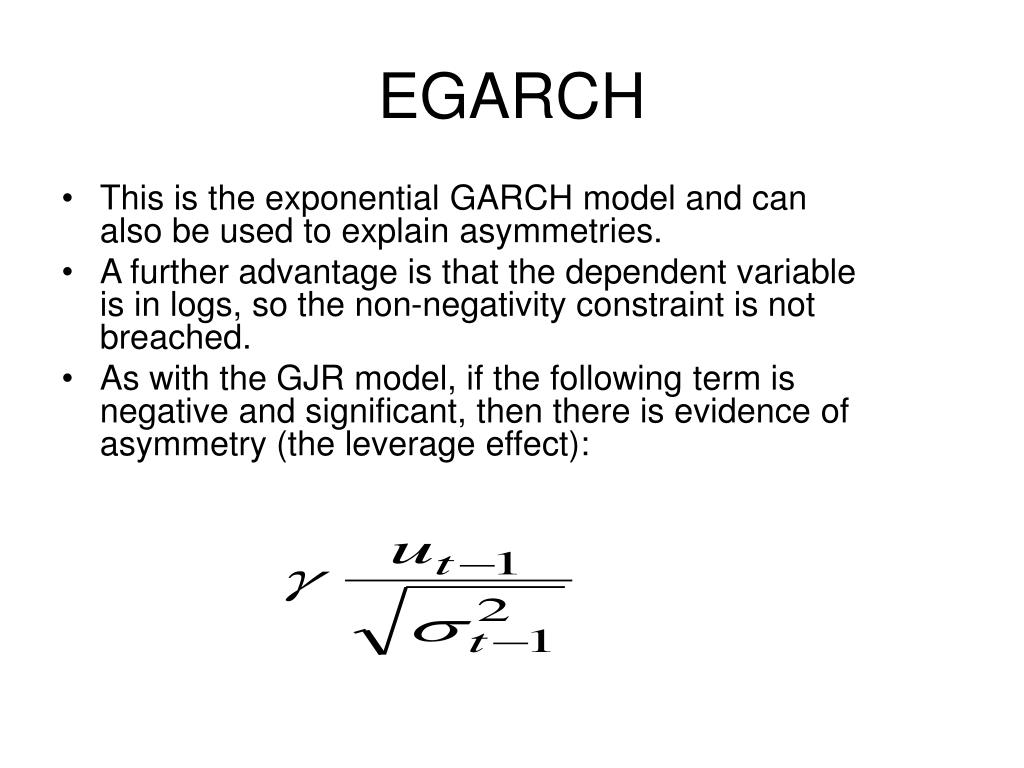

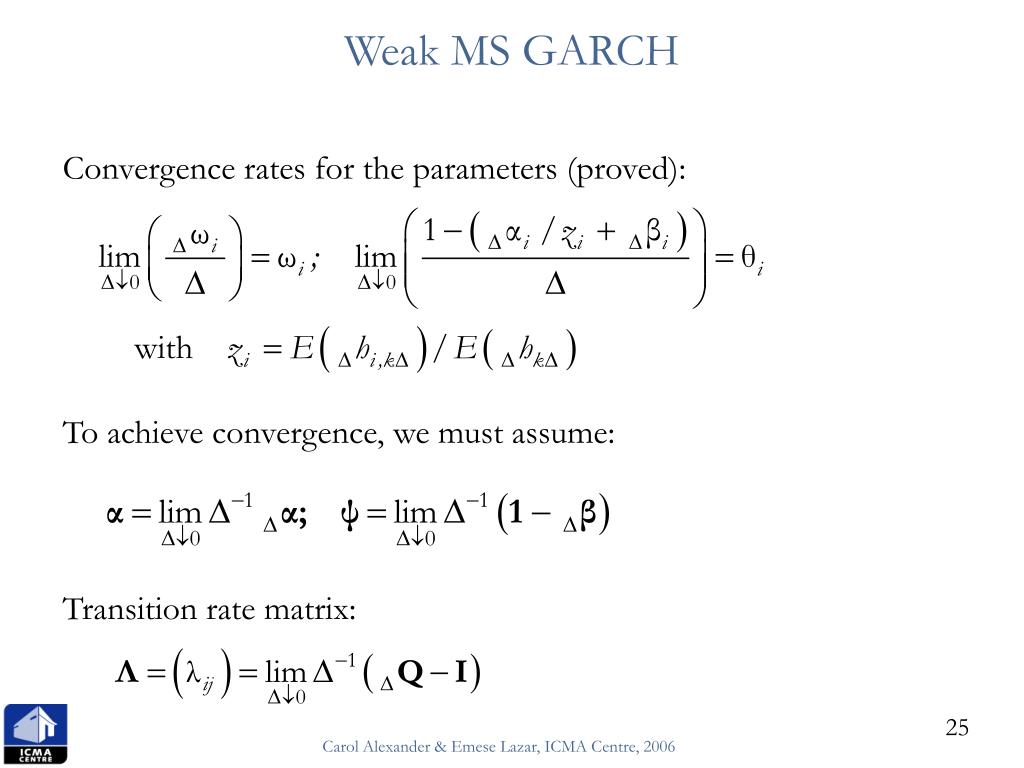

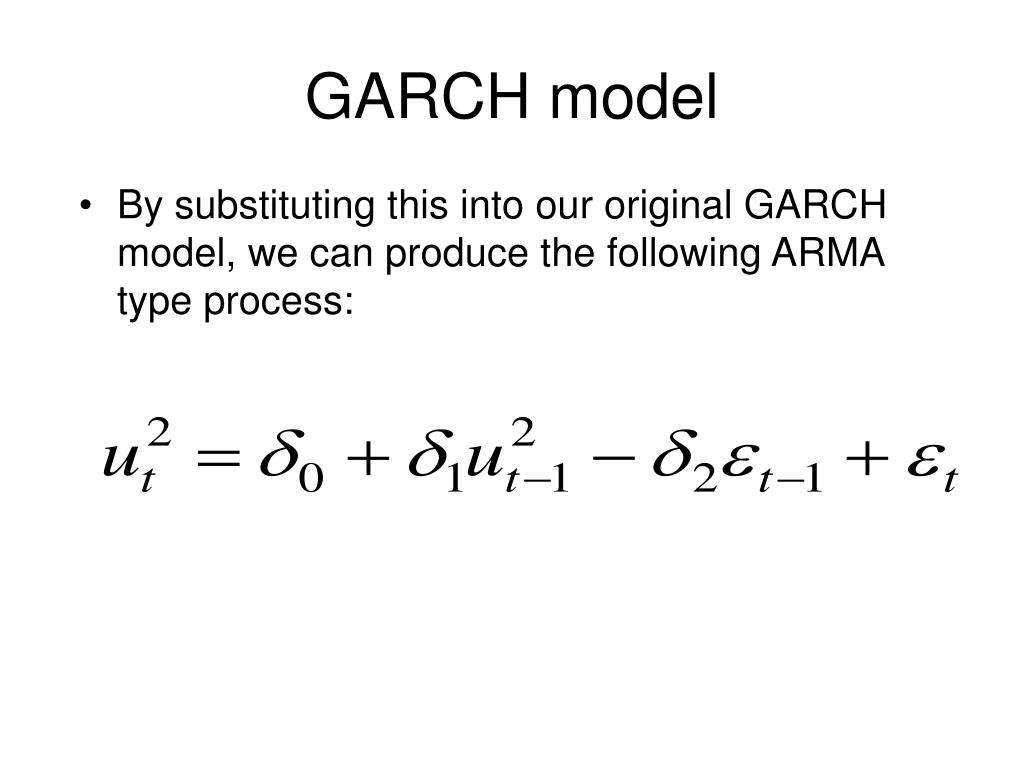

In a weak garch model, ζ 2 (t, h) has the interpretation of a parameterized linear projection for the squared innovation. One of the weaknesses in garch model is the model is symmetric in modelling volatility. Instead of modeling the conditional variance, weak garch.

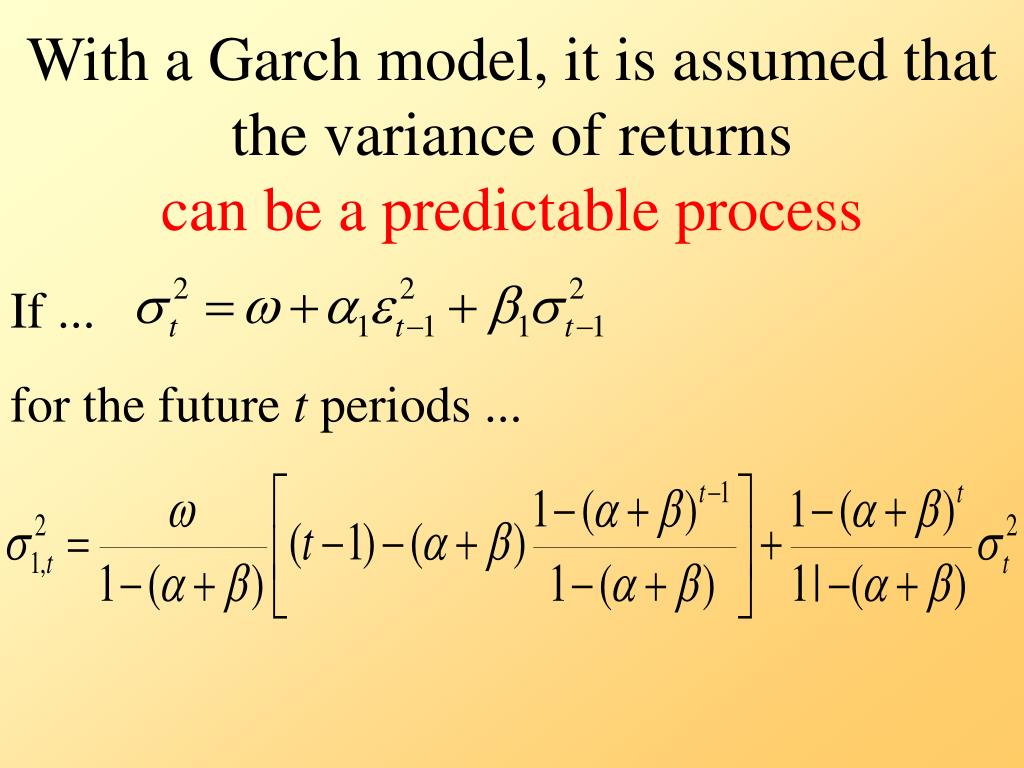

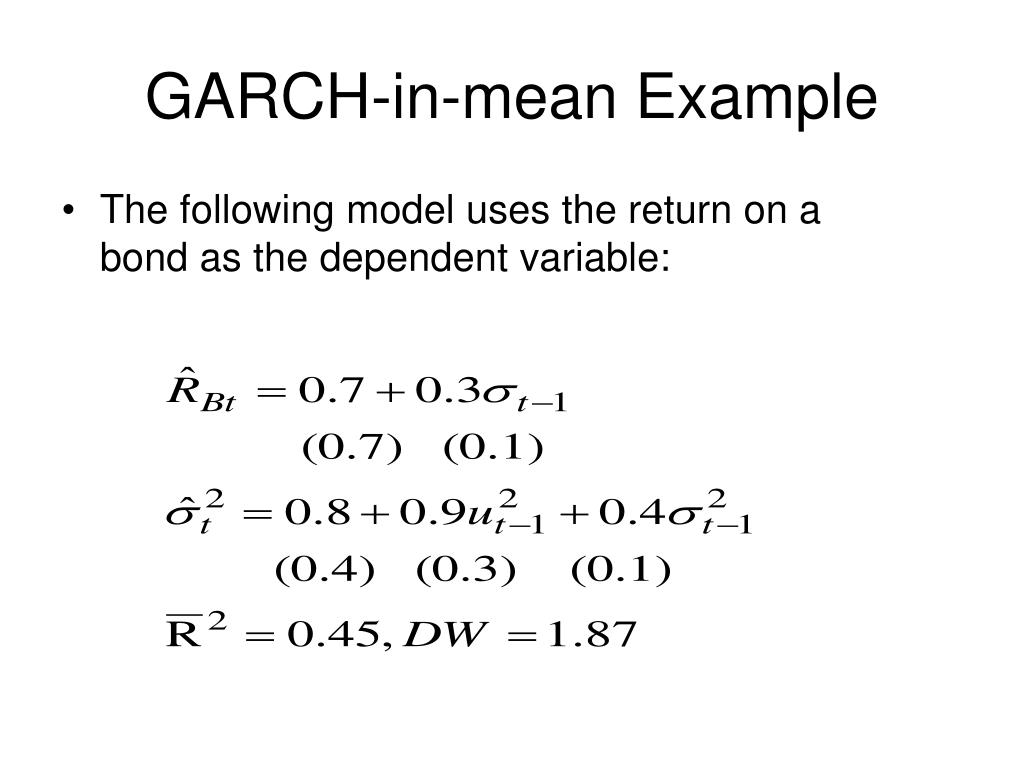

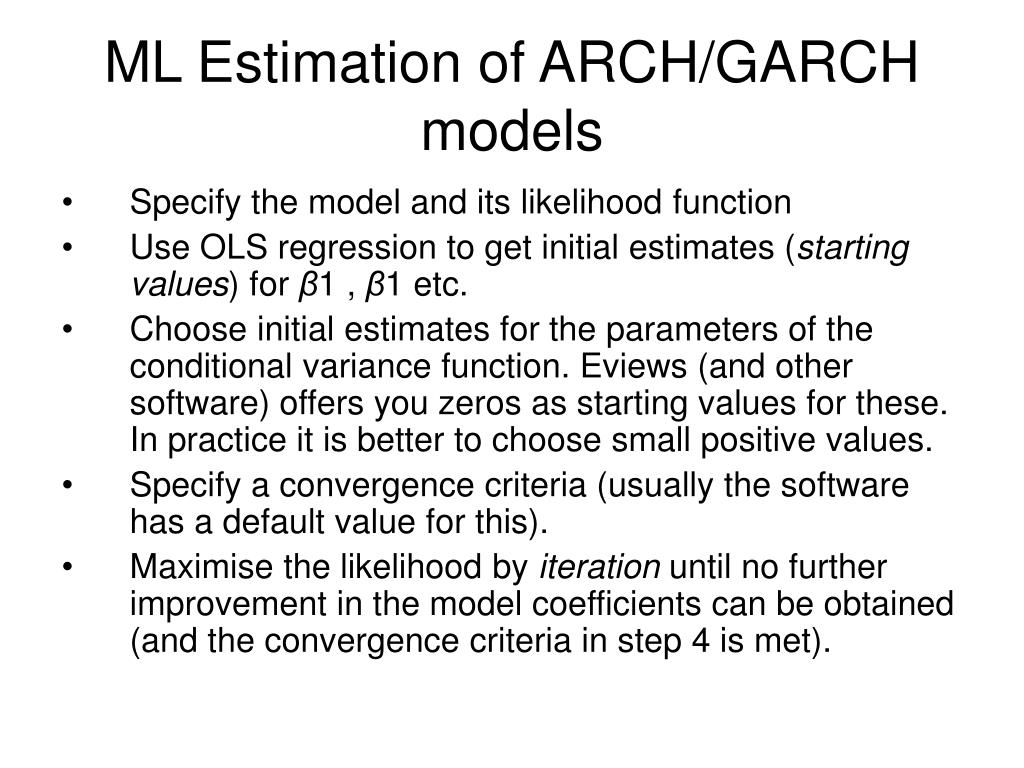

The garch updating formula takes the weighted average of the unconditional variance, the squared residual for the first observation and the starting variance and estimates. Garch model is modified to include the asymmetric feature of stock market volatility. The problem of arch models.

Garch stands for generalized auto regressive conditional heteroscedasticity. The weak garch class of models was explicitly introduced by drost and nijman (1993) and nijman and sentana (1996) to address this issue. Garch models are called ‘strong’ or ‘weak’ depending on the presence of parametric distributional assumptions for the innovations.

The first is an historical estimate based on a simple. Weaknesses of garch model. Can i assume that the long run volatility forecast of a garch(1,1) is higher in periods of high volatility than in periods of low volatility?

Weak arch models are important because they are closed under temporal aggregation. Introduction to arch & garch models. Garch models find applications in forecasting asset price volatility, risk management, portfolio optimization, and value at risk (var) calculations.

If, for example, daily returns follow a weak arch process, then the weekly and monthly. Properties of garch(1, 1) estimation and forecasting. I provide a brief history of the origins of the garch model and my 1986 paper published in the journal, along with a discussion of how the garch model and.

In this blog post, i will detail the simplest but often very useful 4 garch (1,1) volatility forecasting model and i will illustrate its practical performances in the. For the univariate garch model, have shown that only a weak version of it is closed under temporal aggregation.

:max_bytes(150000):strip_icc()/GARCH-9d737ade97834e6a92ebeae3b5543f22.png)