Best Of The Best Info About What Is The Trendline Strategy Bell Chart Standard Deviation

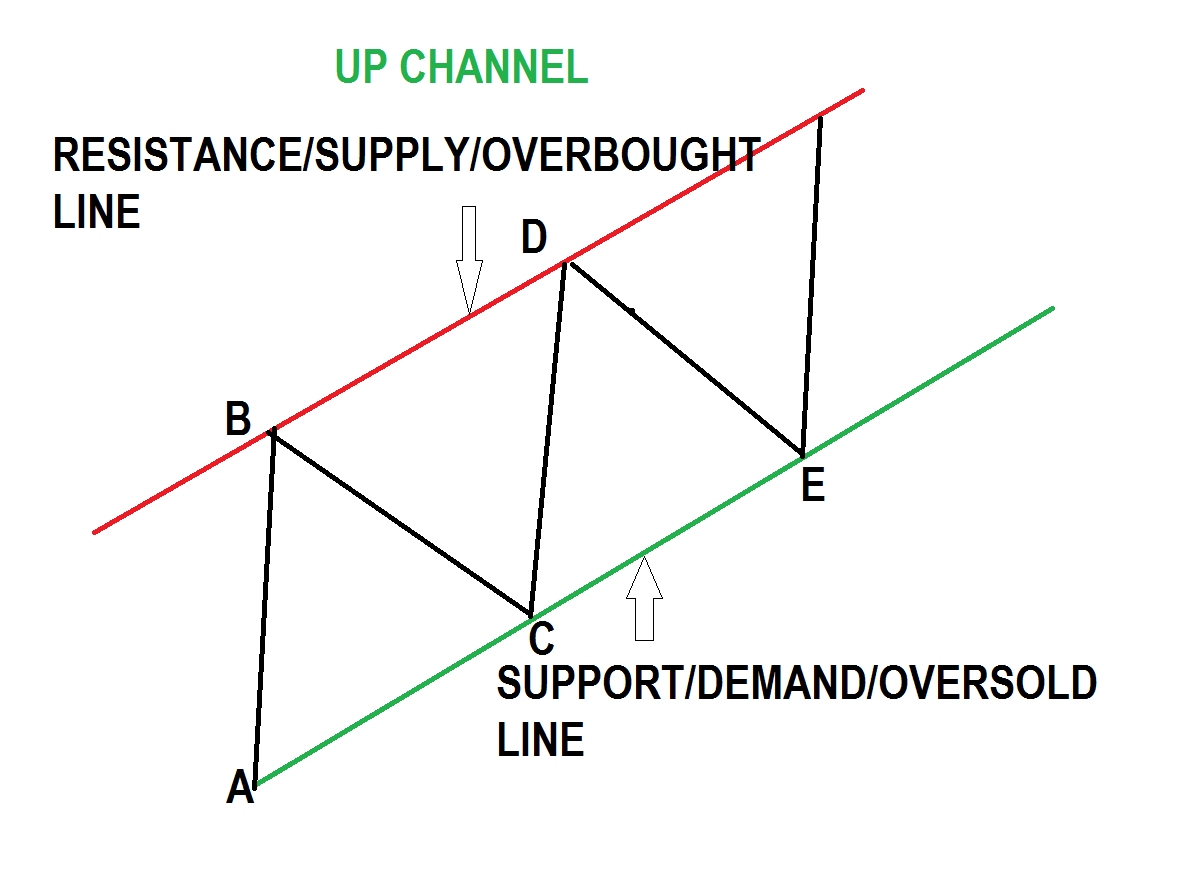

Trendlines visually represent support and resistance in any timeframe by showing direction, pattern and price contraction.

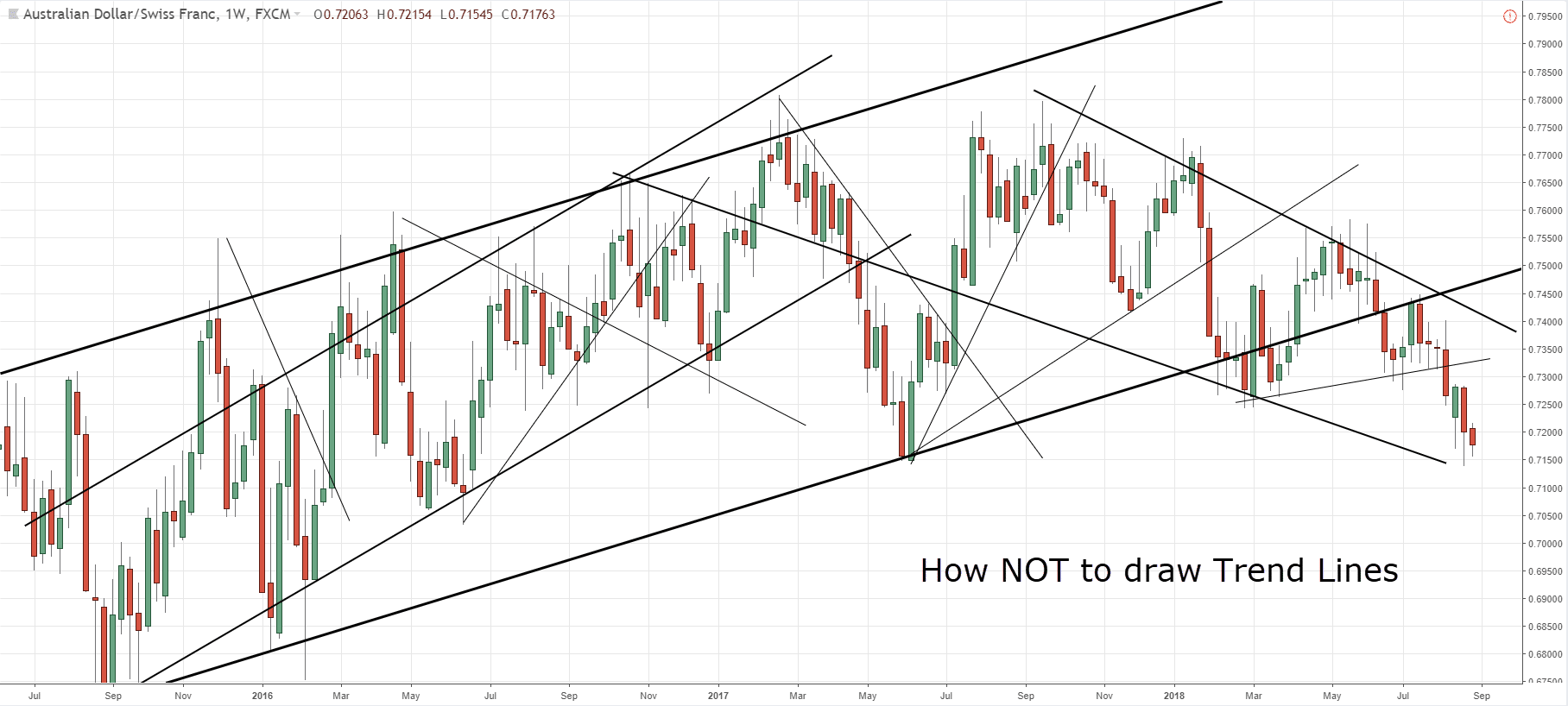

What is the trendline strategy. However, like supports and resistances, trendlines are prone to both fakeouts and shakeouts. This is known as an ascending trend line. How to ride massive trends using a simple trend line technique.

The resulting line is then used to give the trader a good. The trend line breakout strategy. In more basic terms, trend lines involve connecting a series of prices on a chart to reveal the general direction of stock price movements.

How to use trend line to better time your entries. A trendline is an illustrated line connecting changing key points in a graph, to indicate patterns of directional change. Just trace the line and either follow the trend or wait for a breakout.

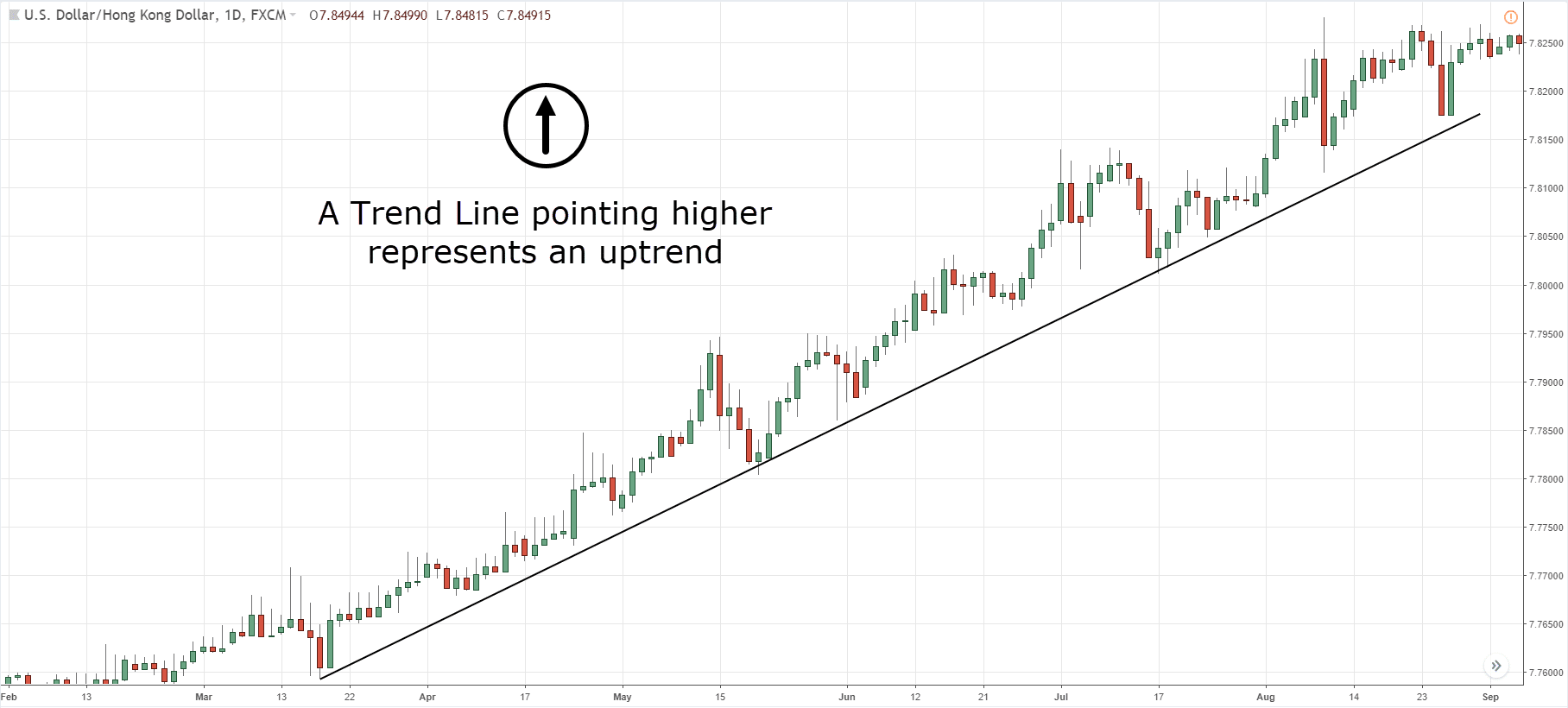

When the price rises, the trendline rises. Trendlines are straight lines connecting key price levels to visualize the direction of the price trend. Its elegance comes from its simplicity:

In their most basic form, an uptrend line is drawn along the bottom of easily identifiable support areas (valleys). A trendline breakout strategy is a trading method that uses the breakout of a trendline to determine a potential trade setup. They also provide insights into whether an asset is a buy or sell at a specific price, and whether a trader should choose to.

Immediate resistance levels are $2.72, $2.76, and $2.81. The ability to identify and draw trendlines is one of the most useful tools in technical analysis. If you are a technical trader, chances are, the trendline is one of the first charting tools that you have learned to use.

The price action will rarely be in a straight line, but there could be moments when price appears to rise or fall to keep in line with the general direction of travel. This is known as a descending trend line. Drawn on price charts, the trendline shows the price trend and helps traders decide whether to buy or sell according to it.

Natural gas price forecast. Trendlines visually represent support and resistance in any timeframe by showing direction, pattern and price contraction. A trendline is an illustrated line connecting changing key points in a graph, to indicate patterns of directional change.

It provides key insights into the financial market and forecasts shifts in trends. Trendlines are simply diagonal lines that represent a price range or trend. By using these tools, traders can make informed decisions about when to enter or exit a trade, potentially increasing their profits and minimizing their losses.

Trendlines are lines that connect consecutive higher lows in an uptrend and lower highs in a downtrend. Elgi equipments is displaying a bullish trend on the weekly chart, characterized by higher highs and higher lows, supported by an upward rising channel, said the brokerage. Trendlines are easily recognizable lines that traders draw on charts to connect a series of prices together.